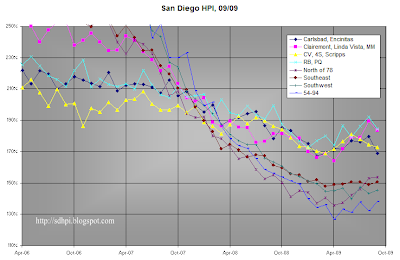

Clairemont and Mira Mesa appear to have staged a strong recovery. Here's a different perspective - smoothed median prices of a few different mid-range neighborhoods over time, and one top-tier neighborhood thrown in for comparison:

If we take two properties, one in Mira Mesa and the other in Ramona, that were worth the same amount, say, 300k in early '02, assuming no structural changes, the one in Mira Mesa is now worth 400k and the one in Ramona is only worth 325k. Other similarly priced peripheral locales, such as Alpine and Fallbrook, have also been underperforming. One possible explanation is that strength of Clairemont and Mira Mesa is due to their proximity to Sorrento Valley / University City tech hub, which has been affected by the downturn to a lesser degree than most of the city.